The modern doctrine of the money laundering industry

Today the money laundering industry often uses many forms of parallel banking systems. This is facilitated by the globalization of the economy, new internet techniques, and the inability of authority to combat transnational constructs.

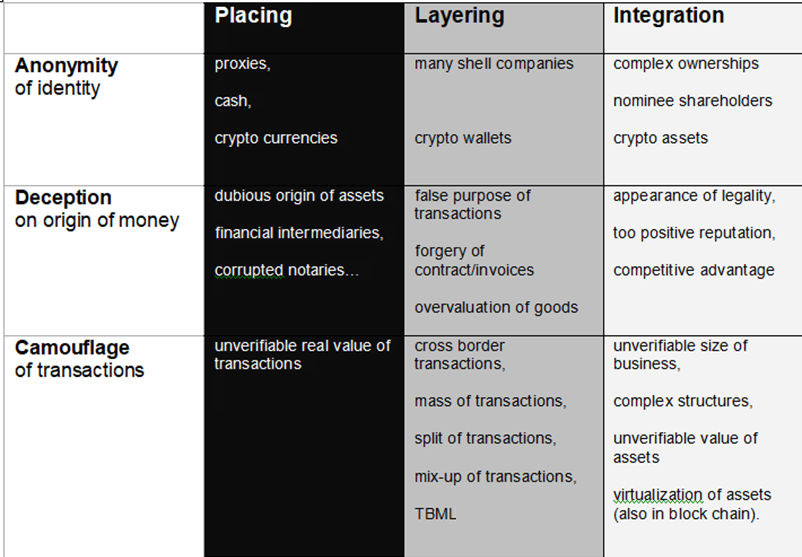

There are so many money laundering systems that it is difficult to notice them all. Still, they all have common characteristics based on infinite variations of the same techniques: the anonymity of identities, the deception of money's origin, and the camouflage of monetary transactions.

These techniques require a variety of specializations and personnel: lend names, notaries, document forgers, crypto experts, web marketing experts, accountants, trustees, bankers or bank employees, public relations, and marketing specialists.

The modern money laundering doctrine is the discipline aimed at describing and codifying the contribution of the money laundering industry in money laundering operations. There are various techniques and disciplines to consider, which I summarize in the chart below.

There are three fundamental processes in the modern money laundering doctrine.

The initial process of money laundering is Placement. It aims to place large sums of cash in the financial system. Placement is not always necessary if the money to be laundered or hidden is already in a financial system. In this case, the process begins with layering.

Layering serves to conceal or disguise the source of the money and confuses investigators, regardless of whether the origin of the funds is criminal or the objective is tax evasion. Transactions may have apparently legitimate business reasons and may also have paper documentation that gives an apparent legitimacy to the nature of the transaction. The layering usually involves foreign countries and a large number of structures (shell companies) and bank accounts. It is also used in an automated and massive way in the crypto world.

The final stage is Integration. It consists of converting the deposited and layered money in the hands of the beneficial owner into a form that the beneficial owner can use without risk of prosecution associated with dirty money or tax evasion. For example, the Integration may take the form of a payment for consulting services, private equity, a real estate broker, an artist, an investment company, an event management or sports company, an art management company, or a venture capital company... to a company or a person with whom the offender appears to have no connection. The Integration can also take the form of crypto assets, like NFT, as an example.

Anti Money Laundering (AML) systems to combat money laundering in banks and financial institutes often focus on the first two processes.

The global money laundering industry is estimated to launder 17,000 B EUR/y annually, of which only 1,000 B EUR/y is related to organized crime and terrorist financing, 5,000 B EUR/y is related to non-tax economic crimes and the rest, 10,000 B EUR/y related to tax crimes. This industry's activity turnover is estimated at EUR 800 B EUR/y.

If you want to know more, don't hesitate to contact me